VENDOME ESTATE is an French Real Estate boutique. We offer a full spectrum of services, designed especially for international buyers

FAQ

In France real estate purchase are made out by the notary who represents interests of the State and bears a civil liability for the transaction. In the beginning the preliminary contract between you and the seller (compromise de vente) is made by the notary subscribes. The contract defines terms of sale, specifies a final price, the information on a condition of object of the real estate, and also a duty of two parties. The given contract assigns to you the real estate, guarantees the price and obliges the seller to remove the real estate from the market of sales. To signing of the given contract the buyer pays a guarantee payment at a rate of 10 % from real estate cost into the account of the notary where it is blocked on the special bank account. After signing of the preliminary contract the notary checks cleanliness of object of the real estate, in particular: the real surface of the real estate; absence of asbestos, lead, termites and other; Whether there correspond to the legislation all civil work spent earlier, whether the real estate is burdened with the mortgage etc. This stage takes about 2 months from the moment of signing of the preliminary contract. After all necessary checks the definitive contract is ready to sign. Before signing the buyer should transfer the remained sum into notary account. In day of signing of the contract the buyer receives the certificate on the property, certified by the notary, and also keys and becomes its full owner.

Notary contribution : usually makes about 6,8 % from the real estate price and it is paid in day of signing of the definitive contract. The given sum is intended on State Tax payment (Duty stamp) on the transaction and payments of notary’s fee. The agency fee: in France it usually makes bentween 3 and 5 % of the price and is already included at total cost of proposed properties.

Such necessity is not present, however the notary according to the “against money laundering” law should prove the identity of the buyer and his residency. A money transfer is possible only from the personal account of the buyer opened in any first rank European or Russian bank from which the notary will ask a letter of recommendation.

Such a necessity is not present. A transaction transfer is possible only from the personal account of the buyer opened in any first-rank European or Russian bank.

It is not. Transaction transfer should be made only from the personal account of the buyer or from the settlement account of the company making purchase, instead of from the third party account.

The land tax or the tax to the real estate (taxe fonciere) is calculated on the basis of a total area of the house or apartment, the size of a ground (if exists), area of the real estate. The municipal tax (taxe d ` habitation) concerns the direct user of the real estate - the owner or its tenant. Usually the sum of the municipal tax is equal to the sum of the land tax. Wealth tax (Impôt sur la fortune). In France the citizens having the property/wealth for the sum over 1 300 000 Euros should pay a special tax on it. This tax is paid annually and makes from 0,70 % to 1,50 % from a real estate cost and depends on price. In case of real estate purchase on credit, it is not taxed, while on it the bank debts are registered. The tax starts to operate only since the moment when the paid sum will reach 1 300 000 euros. The inheritance tax (droit de succession) Tax on the transfer of real estate in the inheritance or gift is not easy to calculate. It all depends on the situation, and can range from 5 to 40% of the tax base. Tax is calculated on a progressive scale of the market price value of property at the time of entry into the inheritance. Since 2007, the spouses are exempt from inheritance tax. If the property has bank debt, tax will be deducted from the amount of paid credit. The profit tax (impot sur la plus value) At the further resale of the real estate the seller should pay the tax from net profit which he has received from the transaction. The given tax extends also on all foreigners, not being tax residents of France. If you are interested in more information on the French tax Vendome Estate will recommend you specialized lawyers.

The real estate ownership in France does give a privilege for tourist visa for stay of 6 months in year for the buyer and its near relations is almost guaranteed. We can recommend you a lower specialized in this matter.

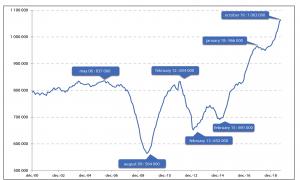

Each Parisian apartment is unique, and its price depends not only on a condition of the apartment, but also from area, beauty and a historical value of the house, street on which it is, a view, a floor etc. Therefore it is difficult enough to answer unequivocally a question on the price. Nevertheless, we can result some data for the avarage market prices, published by the French magazine “Le Monde économique” 26.02.2015

- Quarter Place Vendome, Palais Royal, Chatelet, Les Halles (Paris 1er) 8 000 - 10 000 € / m2

- Quarter Le Marais, Ile de la Cite, Ile St Louis (Paris 4me) От 10 000 € / m2

- Quarter Boulevard St Michel, Panthéon, Jardin de Luxembourg, (Paris 5me) от 10 000 € / m2

- Quarter Saint Germain des Prés (Paris 6me) от 10 000 € / m2

- Quarter Tour Eiffel, Invalides (Paris 7me) от 10 000 € / m2

- Quarter Champs Elysées, «Золотой треугольник», Madeleine (Paris 8me) от 10 000 € / m2

- Quarter Trocadero, avenue Foch, La Muette, Place Victor Hugo (Paris 16me) 8 000 - 10 000 € / m2

- Quarter Parc Monceau, Place des Ternes (Paris 17me) 8 000 - 10 000 € / m2

- Quarter Montmartre (Paris 18me) 8 000 - 10 000 € / m2