French property: Analysis of the market

The analysis of the real estate market is derived from the French property marker report of notaires de France. It presents the real estate situation in France: trend and evolution of real estate prices.

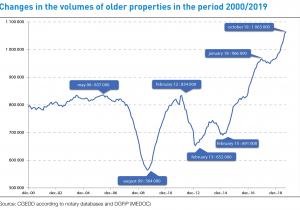

French older properties market

The volume of transactions completed in the last twelve months continues to grow, and since June 2019 has topped the million mark. At the end of October 2019, it stood at 1,063,000 completions. It is still increasing every month, increasingly quickly year-to-date, +6.2% in June 2019 and +10.6% at the end of October 2019. The volume of transactions year-to-date had not grown at a double-figure rate since February 2018.

While the dynamism of certain major metropolises (in particular those in the Grand Ouest region) was confirmed at the end of 2019, the upward trend in this annual activity nonetheless reveals certain regional disparities. However, one should not fear a downturn in volumes, given the number of houses built and the current turnover rate of the housing stock. Albeit very active, the market is still consistent with respect to the number of houses owned by individuals. One can indeed note that the current ratio, i.e. the annual number of transactions divided by the number of houses owned by individuals, stands at 3.3%. This figure is slightly higher than the figure for 1999-2009, which already varied at the time between 3% and 3.2%. The relative stability of this turnover rate with respect to growing volumes in this same period is accounted for by the number of new homes built in the meantime.

The million transactions threshold in these circumstances may seem sustainable in comparable financing conditions. Indeed, this sustained activity is explained among other things by a financial context favouring purchases, given the current interest rates and the strong motivation of households, who more than ever trust investments in bricks and mortar and wish to safeguard their housing budget. The French property market is still above all a market of users.

The notaries observe that activity at the end of 2019 is still sustained, without for all that resulting in a disproportionate rise in prices. In December, they nonetheless noted a decrease in the number of case files received in their offices, which may among other things be correlated with the strikes at the end of this year. The impact of this decrease will start to be felt in two to three months.

New properties: the new housing market

The new housing market - Key figures House building: Figures at the end of October 2019

No records in new housing, unlike older properties. We observe a 20% decrease in offers for sale compared with the figures of the third quarter of 2018. The pre-election period is not a good period for issuing planning permission; many building programmes are suspended to date, heralding a bad first half of 2020. If fewer houses are built, demand will automatically shift to older properties, thereby sustaining prices. The Finance Act for 2020 has nonetheless maintained the interest-free loan scheme for new housing in zones B2 and C for the whole of 2020. Let’s wager that the second half of the year will see a catch-up effect!

https://www.notaires.fr/en/housing-tax-system/french-property-market/fre...